Little Known Facts About Hard Money Georgia.

Wiki Article

What Does Hard Money Georgia Do?

Table of ContentsAn Unbiased View of Hard Money GeorgiaNot known Incorrect Statements About Hard Money Georgia 6 Simple Techniques For Hard Money GeorgiaRumored Buzz on Hard Money GeorgiaThe Facts About Hard Money Georgia RevealedHard Money Georgia Things To Know Before You Buy

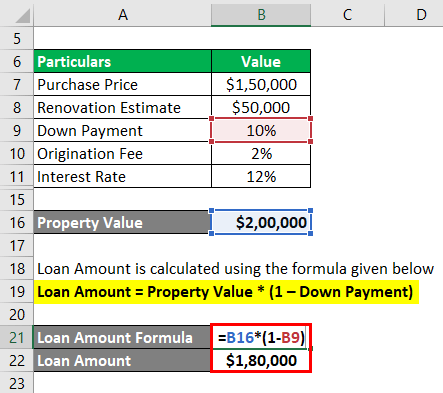

Considering that hard cash financings are collateral based, likewise referred to as asset-based loans, they call for minimal documents as well as permit investors to close in a matter of days - hard money georgia. These loans come with even more threat to the lending institution, as well as for that reason call for higher down settlements as well as have higher interest prices than a traditional loan.In addition to the above breakdown, difficult cash financings and conventional mortgages have other distinctions that distinguish them in the minds of financiers and also lending institutions alike: Tough money fundings are moneyed quicker. Many traditional car loans might take one to two months to shut, however hard cash finances can be closed in a couple of days.

Most tough money car loans have brief settlement periods, usually between 1-3 years. Standard home loans, in comparison, have 15 or 30-year settlement terms typically. Tough cash car loans have high-interest rates. A lot of tough cash funding rates of interest are anywhere in between 9% to 15%, which is significantly greater than the rate of interest you can expect for a traditional home loan.

The 30-Second Trick For Hard Money Georgia

This will include getting an appraisal. You'll obtain a term sheet that details the funding terms you have been approved for. Once the term sheet is authorized, the car loan will be sent to processing. Throughout funding processing, the lending institution will certainly ask for papers and prepare the car loan for last car loan testimonial and also timetable the closing.

A Biased View of Hard Money Georgia

Common leave methods consist of: Refinancing Sale of the property Payment from various other resource There are lots of scenarios where it might be beneficial to utilize a difficult money funding. For starters, investor who such as to house turn that is, purchase a review residence in requirement of a great deal of job, do the job personally or with professionals to make it extra valuable, after that reverse and market it for a higher cost than they purchased for may locate difficult cash financings to be perfect funding options.

As a result of this, specialist house fins typically like short-term, fast-paced financing services. House fins typically attempt to offer houses within much less than a year of purchasing them. Due to the fact Read Full Report that of this, they don't require a lengthy term as well as can stay clear of paying way too much interest. If you purchase financial investment homes, such as rental buildings, you might additionally locate tough money lendings to be excellent options.

Sometimes, you can likewise use a difficult cash car loan to purchase vacant land. This is a good choice additional info for programmers that are in the process of getting approved for a building financing. Keep in mind that, also in the above scenarios, the possible disadvantages of difficult money car loans still use. You need to be certain you can pay off a difficult money car loan prior to taking it out.

The 7-Minute Rule for Hard Money Georgia

If the expression "tough money" inspires you to begin pricing quote lines from your preferred gangster flick, we would not be surprised. While these types of fundings may sound tough and challenging, they are a frequently utilized funding approach lots of investor make use of. What are difficult cash car loans, and also just how do they work? We'll explain all that and more right here.Difficult cash lendings generally feature greater rate of interest rates and much shorter settlement routines. Why choose a hard money loan over a standard one? To respond to that, we need to initially think about the benefits and also drawbacks of tough money finances. Like every monetary device, tough cash car loans included benefits as well as drawbacks.

A tough money financing might be a sensible choice if you are interested in a fixer-upper that might not certify for conventional funding. You can likewise use your existing real estate holdings as security on a hard cash loan. Difficult money lenders generally minimize risk by charging higher interest prices and supplying shorter payment routines.

Some Known Questions About Hard Money Georgia.

Additionally, because private people or non-institutional lenders offer hard money lendings, they are not subject to the very same policies as conventional lending institutions, which make them extra dangerous for borrowers. Whether a hard cash lending is right for you depends upon your circumstance. Difficult money loans are excellent alternatives if you were refuted a traditional funding as well as require non-traditional financing., we're below to help. Get began today!

The application why not check here procedure will normally entail an analysis of the home's value as well as potential. In this way, if you can not manage your settlements, the hard money loan provider will simply relocate ahead with offering the building to redeem its financial investment. Difficult money lenders normally charge greater rate of interest prices than you 'd carry a typical loan, yet they additionally fund their finances faster and also typically need much less documents.

Not known Incorrect Statements About Hard Money Georgia

Rather of having 15 to three decades to settle the finance, you'll commonly have just one to 5 years. Difficult money financings function rather in different ways than standard financings so it is necessary to understand their terms as well as what purchases they can be used for. Hard money loans are usually planned for financial investment residential or commercial properties.Report this wiki page